Beyond ROAS: 10 DTC Ecom Metrics You Can't Afford to Ignore

Overview

TL;DR: True DTC success is found in the "boring" back-end numbers that dictate long-term health and scalability.

-

Profitability Over Vanity: It breaks down why metrics like Contribution Margin (aiming for 30%+) and LTV:CAC (targeting 3:1) are the only way to ensure your brand isn't just "renting" customers at a loss.

-

The Retention Engine: The post emphasizes the "90-day window" and Time to Second Purchase, offering specific tactics like SMS flexibility and habit-building bundles to stop "leaky bucket" churn.

-

De-Risking the Brand: It highlights how to protect your business from market volatility by diversifying SKU Concentration and shifting the revenue mix toward organic and returning customers (40%+).

Intro

If you run a Direct-to-Consumer brand, you likely spend a lot of your day obsessing over Revenue and Return on Ad Spend (ROAS). It makes sense; these numbers are the flashy scoreboard of eCommerce.

But here is the hard truth: ROAS tells you how your ads are doing, not how your business is doing.

To build a brand that survives volatility and scales profitably, you need to look deeper. The real game is played in the metrics that measure retention, efficiency, and true profitability.

The Metrics

Here are the 10 overlooked DTC ecom metrics that actually drive growth—and exactly how you can optimize them.

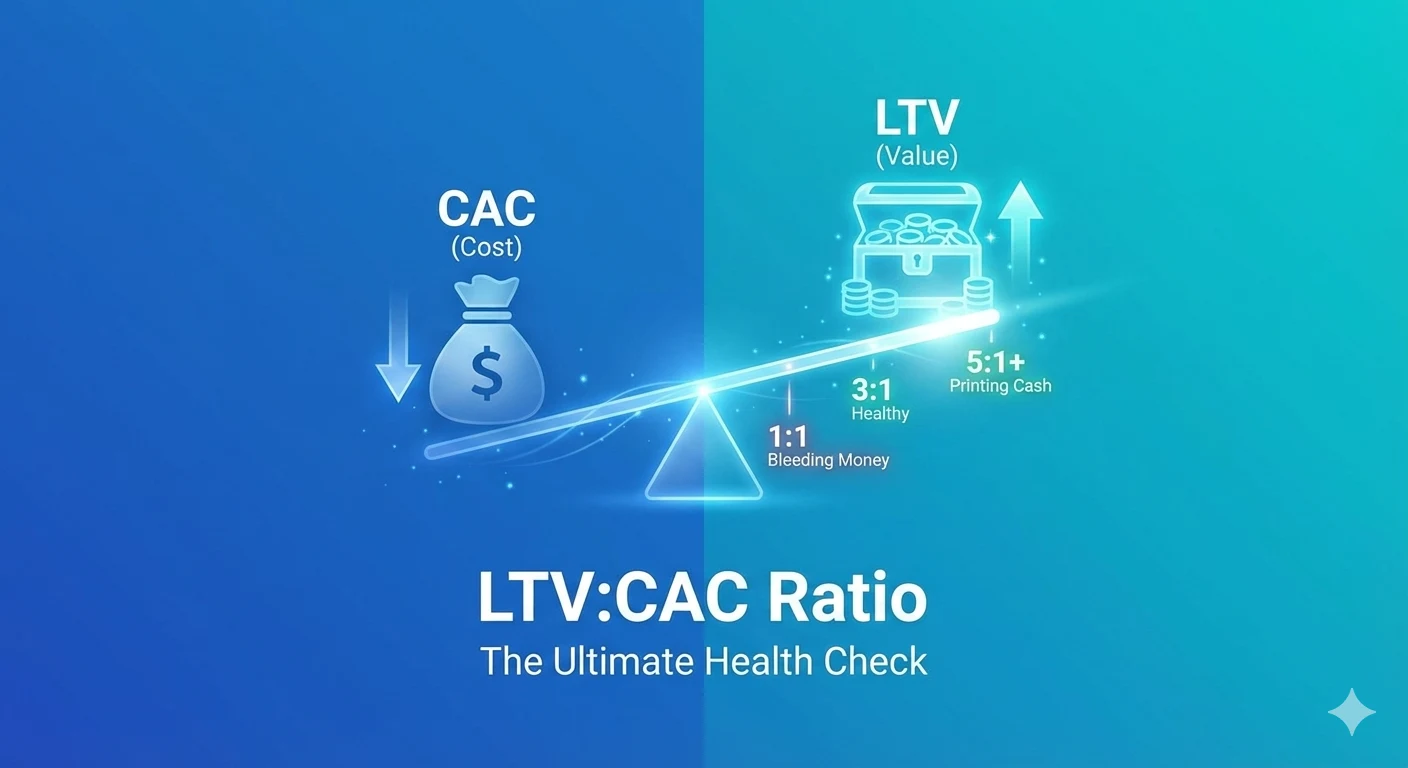

1. LTV:CAC Ratio (The Ultimate Health Check)

This is the single most important metric for understanding the long-term viability of your business model. It measures the relationship between the value of a customer and the cost to acquire them.

The Formula:

LTV:CAC = {Customer Lifetime Value}/{Customer Acquisition Cost}}

The Benchmarks:

- 1:1 Ratio: You are bleeding money.

- 3:1 Ratio: Healthy. This is the industry standard for a sustainable business.

- 5:1+ Ratio: You are printing cash.

How to Optimize It:

If you are stuck below 3:1, you have two levers:

- Lower your CAC: Improve targeting, lean into UGC (User Generated Content) ads, or boost referral programs.

- Increase your LTV: Push subscriptions, introduce upsells, or launch a paid membership.

2. 90-Day Repurchase Rate

Most customer attrition happens in the first three months. If a customer doesn’t buy again within 90 days, the data suggests they probably never will.

How to Fix It:

- Winback Campaigns: Don't just send a generic "We miss you" email. Use targeted incentives based on their previous purchase.

- Bundle Habits: Sell bundles that naturally encourage daily use, creating a habit loop.

- Loyalty Programs: Build a tier system that explicitly rewards repeat buyers early on.

3. Contribution Margin (What’s Actually Left?)

Revenue is vanity; profit is sanity. Contribution Margin (CM) tells you if your unit economics actually work after the dust settles.

The Formula:

CM = {Revenue} - {COGS} + {Shipping} + {Discounts} + {Ad Spend}

The Red Flag:

If your CM is under 30%, you are scaling a business that likely won’t survive unexpected market shifts or ad cost spikes.

How to Get Margins Up:

- Cut your dependency on heavy discounting.

- Negotiate aggressive fulfillment costs.

- Add shipping protection services (like Onward) to boost the bottom line.

4. Subscription Churn Rate

For subscription brands, churn is the silent killer. A high churn rate means your brand is a "leaky bucket"—no matter how much water (new customers) you pour in, the level never rises.

How to Fix It:

- Flexibility is Key: Use tools like Skio to allow customers to easily pause or skip a month via SMS rather than cancelling.

- Variety: Add more delivery options and product variety so subscribers don't get "flavor fatigue."

- Pre-Renewal Perks: Send an email 7 days before the renewal reminding them of the perks they will lose if they cancel.

5. Time to Second Purchase (T2P)

Speed matters. Track exactly how long it takes for a customer to place their second order—then work relentlessly to cut that time in half.

Tactics to Speed It Up:

- AI Recommendations: Use email/SMS flows with hyper-targeted product recommendations based on their first buy.

- Second-Timer Discounts: Offer an exclusive discount specifically for that critical second order.

- Usage-Based Reminders: Calculate the average usage time of your product and send a "Time to Restock?" reminder right before they run out.

6. Gross Margin per Order

At scale, 40%+ gross margins are the checkpoint that keeps you profitable. If you are operating below that, you have very little room for error.

How to Fix It:

- Price Testing: Test a 10% price bump; often volume drops less than margin increases.

- Cashback over Discounts: Reduce percentage-off discounts and offer Cashback instead to preserve perceived value.

- Supplier Negotiations: Revisit terms with suppliers, carriers, and 3PLs regularly.

7. Refund & Return Rate

A high return rate acts as a multiplier on your CAC. If you pay to acquire a customer and then refund the money, you have paid double for zero revenue.

How to Fix It:

- Charge for Returns: It’s controversial, but effective. Charge for returns but offer free exchanges to retain the revenue.

- Clarity: Improve product descriptions and sizing charts to reduce "expectation vs. reality" gaps.

- Post-Purchase Education: Send emails immediately after purchase explaining exactly how to use the product to ensure success.

8. Organic vs. Paid Revenue Ratio

If 60%+ of your sales come from paid ads, you are renting your customers, not acquiring them. Brands with staying power eventually flip this ratio to win on organic channels.

The Fix:

- Invest heavily in SEO and content marketing.

- Build robust affiliate and referral programs.

- Focus on retention tactics (VIP, loyalty, subscriptions) to generate revenue without ad spend.

9. SKU Concentration Risk

This is a measure of fragility. If 80%+ of your revenue comes from a single product (your "hero" SKU), you are vulnerable. If that product goes out of trend or faces supply chain issues, your business halts.

How to Diversify:

- Turn one-time buyers into multi-SKU customers using bundles.

- Offer exclusive add-ons during checkout.

- Create subscription perks that encourage trying new products.

10. % of Revenue from Returning Customers

This is the ultimate measure of brand love. A healthy DTC brand should generate 40%+ of its revenue from repeat buyers.

If You Are Below 40%

Focus immediately on LTV levers:

- Launch VIP memberships.

- Send personalized SMS/Email offers based on purchase history.

- Optimize your post-purchase nurture flows to keep the conversation going.

Summary

Stop looking at just ROAS. By tracking and optimizing for LTV:CAC Ratio, metrics, you shift from a "growth at all costs" mindset to a sustainable, profitable business model.

Ready to implement AI in your business? Get your free AI consultation and discover how Superconscious AI Agency can help you achieve significant productivity improvements.

Frequently Asked Questions (FAQ)

What are the most important DTC ecom metrics to track?

While revenue and ROAS are common, the most critical metrics for long-term health are LTV:CAC Ratio, Contribution Margin, and Retention Rate. These numbers tell you if your business is actually profitable after all expenses and if customers are coming back, which is the only way to scale sustainably.

What is a "good" LTV:CAC ratio for a DTC brand?

A 3:1 ratio is considered the industry benchmark for a healthy, sustainable brand. If you are at 1:1, you are likely losing money on every customer acquired. If you reach 5:1 or higher, you have highly efficient marketing and strong customer loyalty, meaning you are in a prime position to scale aggressively.

Why is my 90-Day Repurchase Rate so low?

A low repurchase rate usually stems from a lack of post-purchase engagement or a product that doesn't naturally create a habit. To fix this, implement winback email flows, offer habit-building bundles, and ensure your first-purchase experience is seamless to encourage that critical second transaction.

How do I calculate my true Contribution Margin?

To find your Contribution Margin, take your total revenue and subtract all variable costs associated with making and delivering the product. This includes COGS, shipping costs, payment processing fees, discounts, and ad spend. A healthy DTC brand should aim for a margin of at least 30%.

Published by Superconscious AI Agency on 2026-01-30. For more AI insights, follow our AI Strategy Blog.